Why video games are the perfect VC category

Pavel Afanasiev, open letter on gaming as a VC category has been published on open VC! Here is a copy of this open letter!

Hi, I’m Pavel, the founder of Northern Lights Entertainment. 👋

As a gaming founder who spoke with 50+ gaming & generalist VCs over the last few years, I wanted to share my findings on why games are a stellar VC category, and why you should consider it in your fund & angel portfolio.

In this 5 parts deep-dive, you will :

- Explore the business side of gaming, which generated stellar returns for early-stage VCs

- Learn about the stakeholder lineup and dynamics in the gaming industry

- Understand why B2C games, not B2B game software, are the clear winners

- Delve into 6 strategies used by games investors

- Discover what a $1-3M seed round buys an early-stage investor

Huge thanks to Julie Bonnecarrère, Amy Wu, Annina Salvén, Sam Lessin, Marcus Howard, and Stephane Nasser for their valuable contributions to the article!

Table of Contents

- 1. Games embody the purest form of the VC Power Law

- 2. A love-hate triangle: Studios, Publishers, VCs

- 3. Games (B2C) outperform game tech (B2B)

- 3.1. The end of the B2B startup factory line

- 3.2 The TAM and profitability superiority of games

- 4. So, what’s the Play?

- 4.1 Founder-chasing

- 4.2 Trend chasing

- 4.3 Audience chasing

- 4.4 Dragon chasing

- 4.5 Content- or Thesis-chasing

- 4.6 Metrics chasing

- 5. Anatomy of a $3M games seed round

- 5.1 Production in a self-sufficient scenario

- 5.2 Production in a continuous funding scenario

- 5.3 Outlook in a self-sufficient scenario

- 5.4 Outlook in a continuous funding scenario

- About the author

- Level up your VC game, read these resources

1. Games embody the purest form of the VC Power Law

For a moment, let’s pretend that the job of a tech VC can be summarized as follows:

- Pursuit of extraordinary returns (VCs routinely target x3-x5 DPI in their presentations to LPs)

- … in large and/or fast-growing markets (where demand is abundant, and where the marginal cost of acquiring 1 user is affordable)

- … through scalable companies (where the marginal cost of delivering a service to an additional user are ~0)

- … generating massive free cash-flow (allowing the company to be sold through IPO / M&A, delivering the returns mentioned hereinabove)

Of course, the job is more complex, and includes raising funds from LPs, posting ghost-written thought-leadership pieces on Twitter and LinkedIn, and staying simultaneously

on-board and away from hype-trains.

Once we take away the investors’ crystal balls (“ serial founders are better ”), the accessories (“ recurrent revenue is better ”), and the laziness (“ Consumer investments are hard ”), the reality is that successful games make insane money.

A true application of the VC power law, if you will.

Some of the most iconic gaming companies have partnered with VC firms early in their journey and reached hundreds of millions of players across the world:

- Electronic Arts with Sequoia

- Zynga with Union Square Ventures

- Supercell with Accel

- King with Index Ventures

- Riot Games with Benchmark, FirstMark Capital

- Rovio with Atomico, Accel

Lesser-known studios with early VC participation still got stellar performance:

- Dream Games with Balderton – reaching $2bn in annual gross revenue run rate in 2023

- Scopely with Anthem Venture Partners – acquired by Savvy Games Group for $4.9bn in 2023

- Peak Games with Hummingbird Ventures – acquired by Zynga for $1.8bn in 2020

- Tripledot Studios with Velo Partners – reached $1.4bn valuation in 2022

And of course, there’s Playrix – didn’t raise a penny of VC money, ever. The studio grossed in $2.7bn in 2021. Talk about FOMO / ”the one that got away”.

2. A love-hate triangle: Studios, Publishers, VCs

Although the success of VC investing in studios is undeniable, it is an exception, not the norm. Historically, most studios secure external funding from game publishers, in exchange for a share of future revenues (a bit like publishing houses for books).

Such rev-share agreements can include anywhere between 30% and 70% going to the publisher, and can sometimes include controversial clauses, e.g. publishers recouping all costs (sometimes at a multiple) before any money goes to the studio.

This historical model is predicated on a Ford-ian division of labor: studios are better equipped to produce games, while publishers specialize in marketing, communications and (especially relevant in the past) – retail distribution, and enjoy established brand-loyalty from players.

Two things must be true for the rev-share model to make sense for a studio:

- The economics of game distribution allows studios to stay afloat even if they forego a significant % of their revenue.

- Studios lack talent / skills / tools / network / appetite to distribute their games, i.e. publishers must enjoy some form of gatekeeping power over studios.

Both of these have come under pressure after the turn of the century:

- The emergence of digital marketplaces for games (e.g. Steam, Google PlayStore, Apple AppStore, Facebook in the past – remember Farmville?) has democratized game discoverability and diminished the importance of publisher brand names and retail distribution.

- The emergence of performance marketing tools and advertising networks (e.g. Facebook Ads, Google Ads, AppLovin, IronSource) has leveled the playing field between publishers and studios, and made the conversion of money into users more transparent and accessible to both.

- The emergence of tools facilitating game development and project management (game engines like Unity or Unreal Engine, or pipeline management tools like Confluence) has shortened the end-to-end development cycle, and lowered the cost, for basic games and prototypes. It has also enabled the development of highly-complex, high-fidelity, high-budget games (known as “AAA” titles).

From a financial perspective, owing 30-70% of revenue to a publisher depresses the Enterprise Value of a studio. Ultimately, what matters is having someone front the cost of production & distribution, but there’s more than one way of financing that upfront expense.

Therefore, some VCs have joined the chat (stepped into the arena?), as they realized that taking early equity positions in studios allows the studios to go to market. The exit strategy? IPO or M&A to large corporations… i.e. publishers!

TLDR: VCs steal publishers’ lunch, and sell it back to them at a premium for dinner, once de-risked.

3. Games (B2C) outperform game tech (B2B)

3.1. The end of the B2B startup factory line

I can already picture a legion of B2B SaaS investors shaking their heads: “ Okay, but do games really scale? We like certainty – recurring revenue, predictable product success, that kind of thing. ”

TLDR: You might not be the venture capitalist you think you are. You will probably do quite well in small-/mid-cap private equity, though. Cheer up!

Long answer: At the very beginning, we summarized the job of a venture capitalist as “Pursuit of extraordinary returns in large and/or fast-growing markets through scalable companies which generate massive free cash-flow. ” Keep that in mind and read on.

Thanks to the zero-interest-rate-policy (ZIRP) environment of 2019-2022 a lot of venture investors gave money to B2B SaaS companies, because of the prominence of what Sam Lessin (GP @Slow Ventures) describes as the factory model of VC : Seed investors knew how to package startups by hitting predictable metrics expected by Series A investors. Series A investors would do the same packaging work and push a startup through Series B. And so on, and so forth – predictably manufacturing unicorns (at artificial $1bn+ valuations) primed for public markets (IPO) and corporate acquisitions (M&A).

That’s where SaaS investors looking for predictability, de-risking and other PE-not-VC things ran into 2 problems:

- As pointed out by Chamath Palihapitya (Founder @Social Capital), most SaaS startups, even in late-growth / pre-IPO stages, structurally cannot generate profit, and were spending venture money on 1) Copying features from one another; 2) Inflating headcount; and 3) Subsidizing prices to attract customers from competitors (who were doing the same). —> No profit = no IPO.

(Side note: Sam Lessin believes that, as an AI-investor, you’ll make more money investing in incumbents – Microsoft, Google, Meta, Nvidia… – not in AI startups.) - Large-cap M&A is dead, as evidenced e.g. by the Adobe + Figma failure, due to regulatory pressure by antitrust authorities. —> No approval = No M&A.

As a result, Brad Gerstner (founder of Altimeter Capital) estimates that 30-40% of the 1400 -or so unicorns, most of which are SaaS, are dead or dying. Sorry.

3.2 The TAM and profitability superiority of games

Let’s go back to our VC job description: Pursuit of extraordinary returns in large and/or fast-growing markets through scalable companies which generate massive free cash-flow.

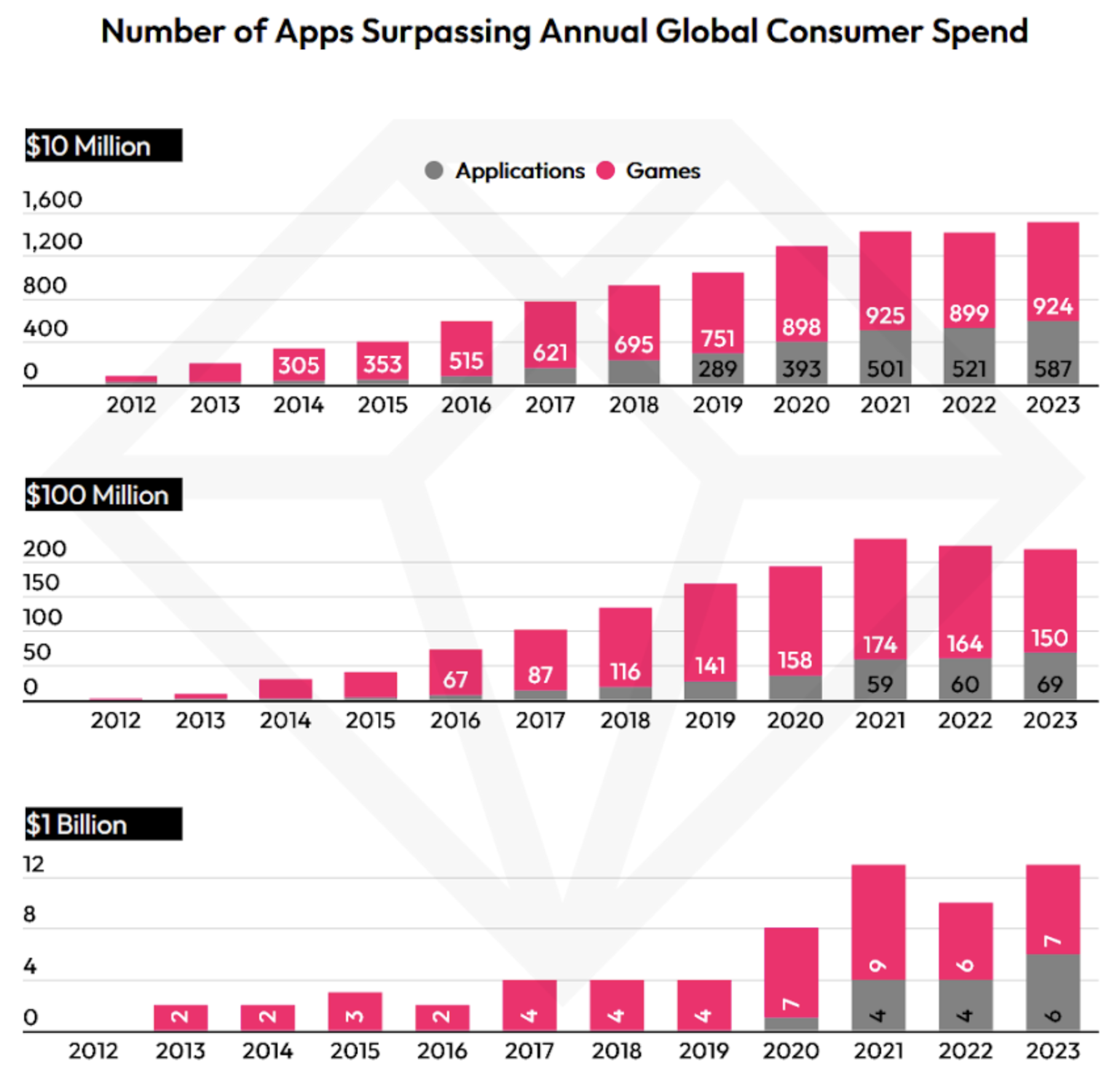

The reality is that the worldwide # of consumers in games is constantly increasing (50% of the planet is your current TAM). Games make more money than film, music and books – combined. Players constantly crave new content and experiences, so barriers to exit are low, which is great for studios that produce new content and execute well. The opposite of AI, if you will.

The true power of games is that players’ purchasing decisions are in the realm of the emotional, “feel-good”, “treat myself”. This is a super-power that doesn’t apply to B2B sales.

Even in the realm of game SaaS (or game tech), studios may hilariously outperform pure players.

To illustrate: There are two dominant game engines today – Unity – a public company – and Unreal Engine – developed by Epic Games – the studio behind Unreal Tournament and Fortnite.

- Unity (a pure player), valued at $13bn publicly, has never been profitable, and most of their revenue comes from operating an advertising network. Full year revenue 2022: $1.39bn

- Epic Games (a studio), held privately, valued at $31bn. Full year revenue 2022: $6bn. Gross profit margin estimated around 40%.

Another example: The dominant marketplace for PC games is Steam, operated by Valve Corporation (privately held). Valve generated about $13bn of revenue in 2022. But the reason that Valve – and Steam – came to prominence, is thanks to iconic game franchises they released (Half-Life, Counter-Strike, Portal, Team Fortress 2) , for which Steam was originally used as a launcher.

Oh, and Valve pioneered the 30% digital marketplace fee that has since then been copied by Apple, Google, Uber etc. So you can thank (or hate) them for that.

4. So, what’s the Play?

6 types of strategies have emerged around games investing. Investors always chase something, so that’s the archetype categorization we’ll apply here. Bear in mind that multiple strategies can apply to a single investment.

4.1 Founder-chasing

Some investors like to rely on past experience as a sign of founder quality and skill. Investing in founders who worked at Google / Facebook / Stripe etc. feels reassuring in the early stages, and applies in games, too – for founders who worked at iconic games studios.

If you operate a very large fund (e.g. Lightspeed, a16z) and are constrained to write large initial checks / have a concentrated portfolio, incentives may force you to back serial founders or experienced studio employees. If you’re wrong, you don’t look like a fool.

Pros: This helps avoid rookie mistakes that younger / less experienced founders and teams might make in game production and distribution.

Cons: Funding founders with similar professional backgrounds and shared references saturates the market over time – leading to standardization and higher costs of acquisition, and copy-cats of these. Imagine the movie industry only funding Quentin Tarantino and Jack Snyder —> no Barbie, no Harry Potter. (credits to Annina Salvén for the parallel!)

In addition, the round size may be too large and pricing discipline can be hard to enforce. Mitch Lasky (Partner @Benchmark) and early investor in Riot Games, summed it up perfectly:

4.2 Trend chasing

The success of League of Legends and DotA in the 2008-2013 era spawned a ton of variations and spin-offs around the “Multiplayer Online Battle Arena” genre. The success of Fortnite and PUBG in 2016-2019 spawned a generation of Battle Royale games. The continued success of Candy Crush has produced multiple winners in the Match-3 genre. The spike of interest in crypto in 2020-2022 created several dedicated VC funds investing in metaverse and web3 games.

Pros : Follow-and-compete strategies have worked for some studios before, in particular in mobile games and casual games. Oh, and Fortnite fast-followed PUBG to become a generational phenomenon.

Cons : Trends can become “red-ocean” quickly, which decimates venture-scale returns. VC perform better as trend-setters, not trend-chasers. If strong network effects are entrenched in a particular game genre (like League of Legends), the barriers to exit to attract players from game A to game B may prove insurmountable. Or a particular trend may prove to be insubstantial, in the long-run.

4.3 Audience chasing

Tens of thousands of games (literally) get released every year, and costs of user acquisition are growing: In part, because privacy regulations make targeting less effective, and in part because while players crave new game experiences, there are a ton of games that compete for their free time. So, some studios choose to build on platforms that have a pre-existing audience and allow creators to monetize user-generated games (like Roblox, Fortnite Creative or Netflix Games – although with Netflix you cannot monetize the game beyond the original licensing / purchasing deal). Others choose to build a player community prior / during game development, to get ongoing feedback.

Pros: Using integrated creator tools massively decreases development cost and the time-to-market. Moreover, studios don’t need to worry about finding and targeting a particular player persona out in the wild.

Cons: Total addressable market can be an issue: How big can your studio (and enterprise value) get, if you are highly reliant on the tools and compensation policies determined by a third-party platform, like Roblox or Fortnite? What happens if the success of these platforms diminishes over time? How representative are your early believers of the size of the actual market?

4.4 Dragon chasing

Theorized by David Kaye (GP @F4 Fund) here – dragons are startups that may not become unicorns ($1bn+ valuation), but that can be fund-returners. It’s a strategy that is particularly interesting for smaller funds.

Pros: You agnostically focus on what matters: Making money for the LPs, across genres, platforms, audiences and trends.

Cons: At larger fund sizes, even a unicorn may not be enough to return your fund. Also, correctly estimating the return profile of an early-stage investment implies that your selection skills are far above the median. In reality, many VCs like to say that their fund returns are top-decile – and simultaneously, ~half of all VCs don’t return meaningful capital to their LPs. How come?

4.5 Content- or Thesis-chasing

This category is the one that defines what the future trends to follow (see above) will be. Pushed to the extreme, this category establishes a new genre / expands the audience / invents radically different gameplay etc. In marketing terms, this is where “blue ocean” stuff happens. It’s usually based on a unique insight / design vision shared among the founders.

Pros: This is the strategy where generalist VCs (listed in part 1) made a ton of money – you will notice that none of them are known as games-specialist VCs, which is telling. This is classical “high-risk, high-reward”, where the VCs knew that they are in fully uncharted territory with little-to-no comparables. With many games released and the market maturing, a highly-differentiated offering can generate spectacular returns (usually referred to as “overnight success, many years in the making”).

Cons: Predicting where audiences and attention will flow in the future is hard. False positives ( betting on a thesis that doesn’t materialize ), and false negatives ( rejecting a thesis which proves true ) are both very real in games investing.

4.6 Metrics chasing

This category is the most obvious one, which is why we put it last. Everybody loves metrics, because they are reassuring. The typical metrics in early-stage games are around user engagement, retention, monetization, and user acquisition cost. Metrics are objective, they allow for benchmark comparison, and fascinating Excel-exercises like the construction of LTV-curves, hockey-stick curves, break-even points etc.

Pros: Metrics can be a great indication of future success and indication of market demand. When everything is looking great (or, at least, promising) the sale – both internally, and to fund LPs is quite easy. During the factory-manufacturing era of startup funding, it also allowed for momentum-investing, pre-emptive rounds, leading to faster mark-ups.

Cons: Early-stage metrics can be unreliable and may deteriorate with scale. By the time the metrics are reliable – you know it, the founders know it, other VCs know it – leading to a larger round, higher valuation etc, reducing the multiple returns on this strategy. This is exacerbated by the fact that some VCs are not really venture investors, as they hate risk. Metrics-driven rounds are very competitive.

Regardless of the strategies you pursue – games investing, more than most other categories, requires conviction-building: Whether it’s around the founding team, the thesis, the audience, the early metrics – and of course, the games themselves.

5. Anatomy of a $3M games seed round

Let’s assume an early stage (pre-seed / seed) round of $1-3M, and a pre-money valuation between $4M and $10M, and analyze it from production and outlook perspectives, across two scenarios: (a) Becoming self-sufficient; (b) getting marked-up through continuous funding.

5.1 Production in a self-sufficient scenario

The studio is on a 18-24 months timer to reach one of the following:

- Break-even;

- Positive unit economics that can be leveraged into non-dilutive user acquisition debt (like a regular business) or non-predatory publisher funding (think 15-30% rev share for publisher).

This is not feasible with high-fidelity / AAA on PC and console, but feasible for mobile or on UGC-oriented platforms. Particularly so, if the studio can take advantage of a game thesis or a gaming / macro tailwind, which lowers user acquisition costs and/or broadens the audience.

Geographies that offer generous subsidies or match private funding (typically: Western Europe & Nordics) or benefit from lower cost of talent (typically: Middle-East, Africa, India, South-East Asia) are at an advantage here, extending runway.

Depending on the studio, it may result in multiple “shots on goal” (e.g. quick prototyping of casual games), or continuous iteration around one title.

5.2 Production in a continuous funding scenario

If founders & investors choose this route, the above still applies, but high-fidelity titles become a viable option, if:

- The funding environment is friendly, not hostile; and

- There’s interest from existing and potential investors to continue funding through Series A / B etc, once the Seed / Series A milestones have been cleared; or

- A large-scale publishing deal can be reached after seed-stage de-risking.

5.3 Outlook in a self-sufficient scenario

Assuming no follow-up VC funding, the investors maintain 20-25% undiluted ownership, until an exit event materializes. As demonstrated historically, it’s possible for games studios to reach billion-dollar outcomes based on a few million in seed funding, or with no funding (Playrix).

Likely exit events are either a strategic acquisition by a gaming major (e.g. Riot Games acquired by Tencent), or an IPO (Zynga). At $30M acquisition (not uncommon) and assuming 7 years to liquidity, you make between:

- x2.3 (3M at 10M pre-money) and 12.7% IRR

- x6 (1M at 4M pre-money) and 29.1% IRR. The entry price matters!

5.4 Outlook in a continuous funding scenario

Same as a) with greater dilution, unless pro-rata is continually ensured.

There’s a case to be made that games studios should need no more than 2-3 rounds of funding: 1 for development & testing, 1 for growth and internationalization, and the last (optional one) as pre-IPO.

Assuming multiple rounds of financing, 11 years to liquidity, 5% terminal ownership and a $1bn sale / IPO, you make between:

- x50 (1M at 5 pre-money), and 42.7% IRR

- x16.6 (3M at 10M pre-money), and 29.1% IRR

On a personal note, if I were investing, strategy #5 (thesis-/ content-driven) seems appealing. No matter how smart or experienced investors may be, reality demonstrates that they can’t predict the future based on founder experience or early metrics. Therefore, traditional rules of seed investing apply: Be early, be weird, maintain price discipline.

Good luck out on your quest, brave investor!

About the author

Pavel Afanasiev is the cofounder & CEO of Northern Lights Entertainment, a games studio that targets high-engagement societal issues and turns them into games, for audiences of 100M+ players. In Nebulae, their 1st game, players collectively control various political regimes and experiment with new forms of political governance in space.

Say hi on LinkedIn or Twitter !

Level up your VC game, read these resources

Some amazing resources by game experts and VCs for you:

- Atomico on games investing: Part 1, Part 2

- Deconstructor of Fun, on what makes successful games: Newsletter, Blog, Podcast.

- Collection of essays by Shawn Foust, COO at Fortis Games: Hello World , The Game Investment Game , The Design Lane , Look at All the People , Games, the Lingua Franca

- All of the Game Stuff Substack by David Kaye, GP at F4 Fund: Game Stuff

- Gaming market newsletter deep-dives & industry reports by the Konvoy Ventures team